Connect With Our Team

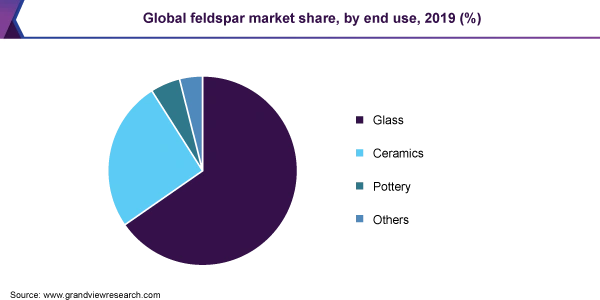

Feldspar is a very important type of mineral more than 60 percent of the earth crust consists of feldspar taking a backbone of the industrial domains that include ceramics and glass manufacture to paint and fillers. Soda feldspar and potash feldspar are the two types of feldspar most often used due to specific chemical properties and flexibility of utilization in production. The feldspar market is in the boom of growth and innovation as the world demand in construction materials, automotive glass and ceramics increases.

The feldspar market has undergone a lot of growth over the last few years. In 2025 the worldwide market size is expected to be over 5.4 billion and to achieve close to 9 billion by 2029 at a compound annual growth rate (CAGR) of approximately 10 percent. It can be attributed to the thriving construction industry, rapid urban development, and the growing popularity of automotive vehicles, where glass requires feldspar to reduce its cost. Technological advancement and innovative applications in different sectors also favor the market.

The main commercial feldspar is soda feldspar (plagioclase group) and potash feldspar (potassium group). In glass and ceramics, potash feldspar is particularly treasured because of its fluxing ability to lower the melting point and enhance product strength.

The principal applications are glassmaking, ceramics, fillers, and coatings. Alumina contained in Feldspar enhances resistance to chemical and vigor, thus making it a popular material in the sectors.

The market is dominated by Asia-Pacific then Europe and North America. The region has been attributed to dominate the region due to the glass making industries and ceramics and the quick economic growth in the region by countries such as China and India.

Asia-Pacific is the largest feldspar market in the world with more than 44 percent of the total volume in 2021. This has been dominated by a strong construction sector, thriving ceramics industry, and the global highest automotive production center in China and India. Europe is the second largest market that holds large reserves and productions in Italy and Turkey. China specifically is also a huge producer and consumer with specific supply-demand characteristics, and a thriving downstream industry.

Several global trends are shaping the future of the feldspar market:

Sizzling Construction and Infrastructure: The high rate of urbanization particularly in the developing countries is boosting the use of ceramic tiles, and glass which both depend on feldspar.

Technological Advances: feldspar technologies has seen an improved technology in the mining and beneficiation of feldspar to achieve a high quality and cost effective process.

Sustainability Focus: Companies are considering feldspar as a safe, non-toxic additive, largely thanks to new interest in using eco-friendly construction materials.

Energy-Efficient Ceramics: The new technology in kilns has increased the energy-efficiency of feldspar based ceramic manufacturing which has again increased the demand.

Despite robust growth, the feldspar industry faces several challenges:

Environmental Regulations: The production timelines can be affected by the fact that mining activities should be done in line with new environmental regulations which are stringent.

Volatile Raw Material Prices: Raw material prices are volatile due to the effects of transport cost and labor cost, especially in markets that emphasize exportation.

Threats of Substitutes: Quartz and other minerals are some of the potential sources of substitutes to feldspar depending on the specific demands of application.

Adapting to these challenges requires innovation, better logistics, and sustainable practices.

Future of the feldspar market appears positive as demand is likely to continue high in construction, automotive industry as well as in energy industry. With the increasing global movement toward eco-sensitive manufacturing, feldspar will emerge as a finished product in green buildings and technologically advanced ceramics.

Manufacturers will also enhance efficiency and production through digitalization in mining and value chain optimization. As the global feldspar demand is likely to top USD 2.5 billion by the year 2030, the stakeholders have to keep themselves abreast with the evolving technology and environmental parameters in order to remain competitive.

The feldspar market is poised for continued growth, underpinned by rising demand in construction, automotive, and ceramics, as well as ongoing technological innovation. Both soda and potash feldspar remain essential to modern manufacturing, and their role will only expand as industries seek sustainable, high-performance materials. For stakeholders and investors, staying attuned to regional dynamics, emerging trends, and evolving end-user needs will be key to capitalizing on this dynamic market.

At Mactus, we combine advanced beneficiation techniques, consistent quality control, and a customer-centric approach to supplier feldspar minerals that meet evolving industrial standards. Whether you're sourcing for high-strength ceramics or energy-efficient glass production, our solutions are engineered for reliability and long-term value.

Feldspar is widely used in the manufacture of glass, ceramics, paints, plastics, and as a filler in various industrial applications.

Soda feldspar contains sodium, while potash feldspar contains potassium. Potash feldspar is preferred in glass and ceramics for its superior fluxing ability and higher melting point.

Asia-Pacific is the leading region, driven by strong demand from construction, ceramics, and automotive industries, especially in China and India.

Key trends include technological advancements in mining and processing, increased focus on sustainability, and expanding applications in new industries.

Whatsapp Chatx

Hi! Click one of our representatives below to chat on WhatsApp or send us email to [email protected] [email protected]

|

Mr. Vivek Rajpara +91 75750 53447 |

|

Mr. Nikunj Vadaliya +91 98240 66283 |